NC NC-4P 2013 free printable template

Show details

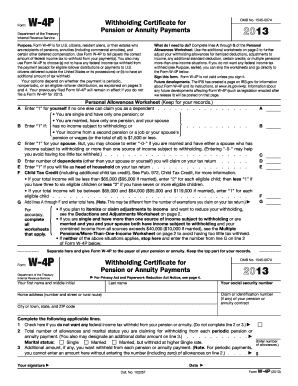

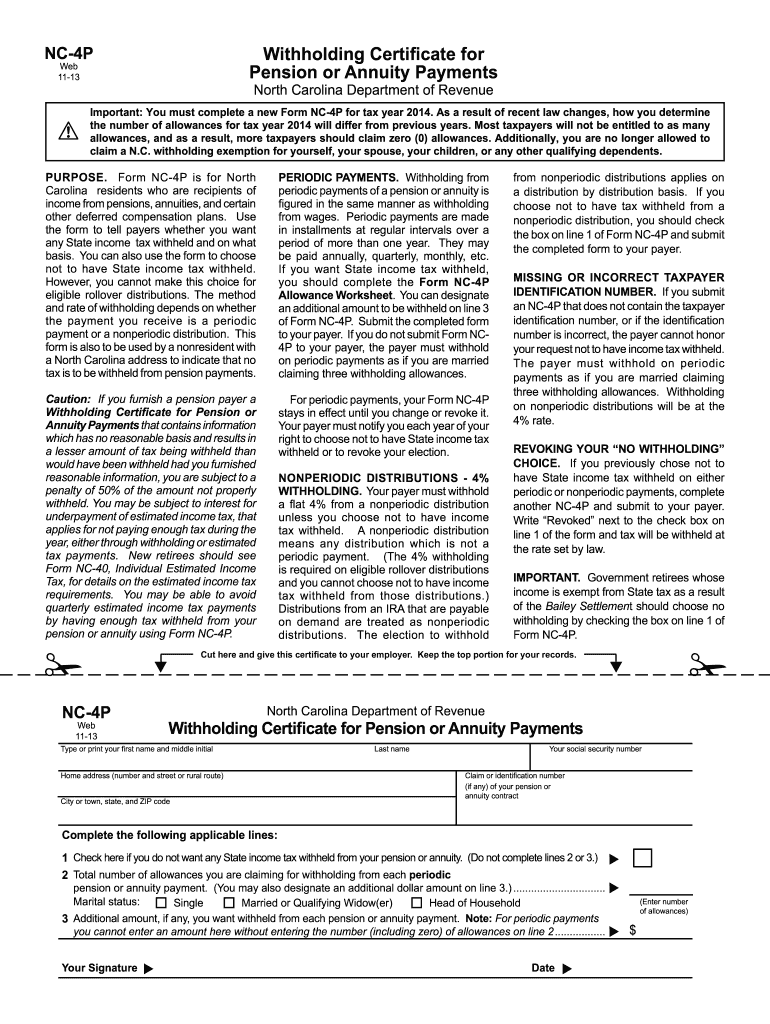

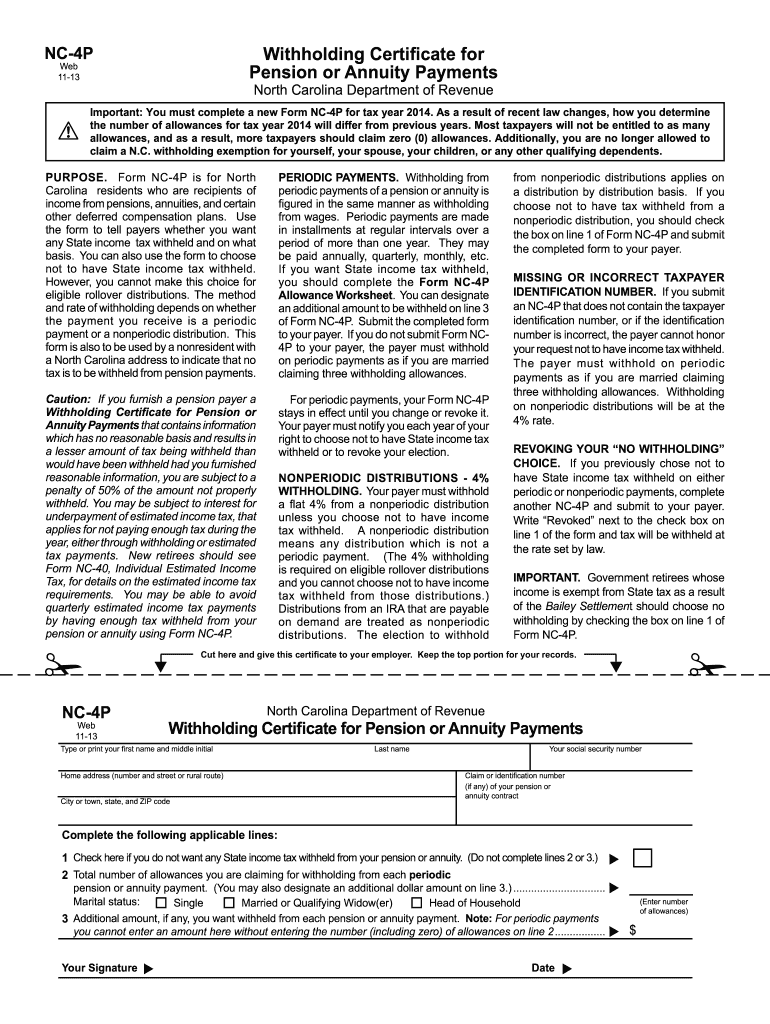

Allowances. Otherwise enter THREE 3 on Form NC-4P Line 2. NC-4P Part II. Enter your total estimated 2014 N.C. You can designate an additional amount to be withheld on line 3 of Form NC-4P. Submit the completed form to your payer. They may be paid annually quarterly monthly etc. If you want State income tax withheld you should complete the Form NC-4P Allowance Worksheet. Enter the number of allowances from line 14 that your spouse plans to claim. 15. Form NC-4P Withholding Certiicate for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nc 4p form 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc 4p form 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nc 4p form 2013 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nc 4p form 2013. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NC NC-4P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nc 4p form 2013

How to fill out the NC 4P form 2013:

01

Gather all necessary information and documents such as personal identification, Social Security number, tax records, and any other relevant financial information.

02

Read the instructions provided with the form carefully, ensuring that you understand the requirements and any specific guidelines for filling it out.

03

Begin by entering your personal information accurately, including your name, address, and Social Security number in the appropriate sections of the form.

04

Provide details about your income, deductions, and tax credits in the designated sections of the form. This may include information about employment income, self-employment income, investment income, and any other sources of income or deductions you may have.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Sign the form and date it as required.

07

Submit the completed form to the appropriate tax authority by the specified deadline. Be sure to retain a copy for your records.

Who needs the NC 4P form 2013:

01

North Carolina residents who are required to file state income taxes for the tax year 2013.

02

Individuals who have earned income, self-employment income, or other sources of income that exceed the minimum filing requirements set by the North Carolina Department of Revenue.

03

Taxpayers who want to claim deductions, credits, or exemptions specific to North Carolina state taxes for the tax year 2013.

Fill form : Try Risk Free

People Also Ask about nc 4p form 2013

Do I fill out nc4 or nc4ez?

How many allowances should I claim on NC-4?

Do I need to fill out a W-4P form?

What is an NC 4P form?

How many allowances should I claim on form W-4P?

What is the purpose of form W-4P?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nc 4p form?

The NC-4P form is a state tax withholding form used in North Carolina, United States. It is the Employee's Withholding Allowance Certificate for Part-Year or Nonresident and is used to determine the appropriate amount of state income tax to be withheld from an employee's wages based on their filing status, exemptions, and other factors.

Who is required to file nc 4p form?

The NC-4P form is used by employees to indicate their North Carolina income tax withholding allowances. It must be filed by each employee who works in North Carolina and is subject to state income tax withholding.

How to fill out nc 4p form?

To fill out the NC-4P form, which is the Employee's Withholding Allowance Certificate, follow the steps below:

1. Obtain the form: Download the NC-4P form from the North Carolina Department of Revenue website or request a physical copy from your employer or the appropriate department.

2. Personal information: Enter your name, mailing address, Social Security Number, and date of birth in the designated fields.

3. Marital status: Indicate your marital status by checking the appropriate box. If married, you can choose to file jointly or separately. If you're unsure about your status, consult a tax professional for advice.

4. Allowances: Determine the number of allowances you want to claim. The number of allowances depends on various factors, such as dependents, exemptions, and deductions. Review the worksheet provided with the form to calculate your allowances accurately.

5. Additional withholding: If you wish to have additional federal income tax withheld from your wages, you can specify a specific dollar amount in this section.

6. Signature: Sign and date the form to certify that the information provided is true and accurate.

7. Submit the form: Provide the completed NC-4P form to your employer, who will use the information to calculate the appropriate amount of state income tax to withhold from your paycheck.

Note: Keep in mind that while this response offers general guidance, it's always a good idea to consult with a tax professional or the North Carolina Department of Revenue for specific instructions or if you have any doubts or complex situations.

What is the purpose of nc 4p form?

The purpose of the NC 4P form is to determine the amount of state income tax to withhold from an employee's wages. It is used by employers in North Carolina to calculate the correct amount of state income tax that needs to be withheld from an employee's paycheck based on the employee's filing status and number of allowances claimed.

What information must be reported on nc 4p form?

The NC-4P form, also known as the North Carolina Employee's Withholding Allowance Certificate for Pension or Annuity Payments, is used to determine the amount of North Carolina income tax to be withheld from pension and annuity payments. The information that must be reported on the NC-4P form includes:

1. Personal Information: Name, Social Security Number, and Address.

2. Filing Status: Select the appropriate filing status, such as Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

3. Number of Allowances: Indicate the number of allowances claimed for North Carolina withholding. These allowances are based on the individual's personal situation, such as dependents, marital status, and eligibility for tax credits or deductions.

4. Additional Withholding: If the individual wishes to have additional withholding, they can specify the additional amount they want to be withheld per payment.

5. Signature: The form must be signed and dated by the taxpayer.

It's important to note that the NC-4P form is specifically for pension and annuity payments and is different from the regular NC-4 form used for other types of income.

What is the penalty for the late filing of nc 4p form?

The penalty for late filing of the NC-4P form, which is a Withholding Certificate for Pension and Annuity Payments, varies depending on the specific circumstances and the policies of the taxing authority. In general, the penalty may include fines, interest charges, and potentially increased scrutiny or audits. It is advisable to contact the North Carolina Department of Revenue or a tax professional for accurate and up-to-date information regarding the specific penalty for late filing of the NC-4P form.

How do I execute nc 4p form 2013 online?

pdfFiller has made it simple to fill out and eSign nc 4p form 2013. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit nc 4p form 2013 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing nc 4p form 2013.

Can I edit nc 4p form 2013 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute nc 4p form 2013 from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your nc 4p form 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.